How startupers from Uzbekistan received $150 000 from a foreign fund

"BILLZ," so called startup project of young guys from Uzbekistan who could attract attention of foreign investors, and then, their investments!

$150 000 was attracted in a trade automation startup called "BILLZ." Their investor was the British fund Sturgeon Capital. Sturgeon Capital is a fund based in London that specializes in emerging markets. Previously, the fund was invested in Uzbek companies such as Universal Sug 'urta and Alliance Leasing.

We interviewed the founder of "BILLZ" Rustam Hamdamov and junior analyst of the fund "Sturgeon Capital" Robin Butler.

Founder of "BILLZ," Rustam Hamdamov:

- Tell us briefly about "BILLZ," what is this project and what does it specialize in?

- "BILLZ" is a startup that helps small and medium-sized retail businesses manage stores and develop online trading, attracting $150K in the first round of investments from the British Sturgeon Capital Fund, estimated as nearly $800K.

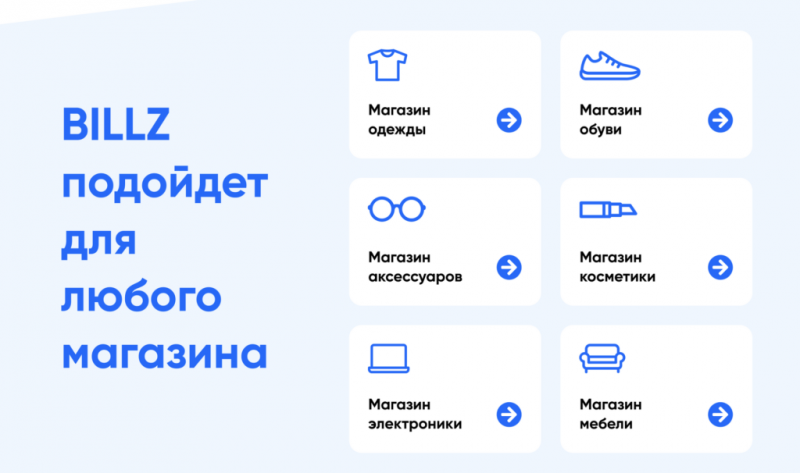

“BILLZ” was founded in 2017 and has since developed solutions in the field of online and offline trading automation, which today are used by almost 400 stores throughout Uzbekistan, including customers who sell through online stores and Telegram bots.

“BILLZ” main audience is clothing, footwear, accessories and other fashion stores.

- How did you come to the idea of creating "BILLZ"?

- In 2016 I attended an online school from Stendford University with my colleague Vadim Zakharyan. Together we worked at Ucell, he ran the development department, and I ran a small team in a group of new technologies and innovations. At Ucell, together we created different products and solutions.

In online school we were taught how to create products, test ideas and launch start-ups. From that moment on, we caught fire with the idea of creating our own startup and thought about different ideas.

At the time, we had another colleague, Jakhongir Narzullayev, who left Ucell to focus on developing retail business in the field of sale of children's shoes. One day we accidentally met him, and he started talking about his problems with managing the store and keeping records in it.

After that, the idea came to us to create a product that would help to establish accounting, manage clients and statistics in the store. We conducted more than 10 interviews with different representatives of trade and realized that they all have approximately the same problems and solutions on the market do not much suit them either in terms of functionality or service.

After an approximate assessment, we realized that this market is at the initial stage and according to our calculations only about 2% of outlets in Uzbekistan were automated, and this inspired us to create our startup even more.

Jahongir shared the main problems he then experienced in his business, and Vadim and I and our first development team tried to turn it all into a product. The first version of the product we just wanted to show to Jahongir, but it was not good enough, so he just refused. I had to look for other clients, and we found them.

After a certain time when we decided to establish the company and turn that into a business, Jahongir joined us as one of the founders and from that moment on we started to develop the company together. We test all the ideas on his shop.

- What did you focus on when implementing the project?

- When we started creating the product we talked a lot to a potential audience and gradually studied their problems. Some spoke about them openly, some of us had to watch.

In the course of various interviews and observations we realized that there are no full solutions on the market, where there would be a good product and client service. There were companies that have a good product, but according to their clients "estimates not very good service, or on the contrary, not bad service, but not enough functional product.

Therefore, we always try to pay special attention to the service and product to become a technical partner for our clients.

In our product there is still a heap of everything that it is necessary to make, correct, correct or improve, but the most important that we know in what direction to move and try to improve and finish it slowly.

- Tell us about the uniqueness of your product?

- I won’t tell that we have any uniqueness in product. We do mostly what is already invented, but always try to make it much more convenient, intuitive and better to solve the client’s problem. Most likely, it is more about the approach to solving problems in product development.

We always try to pay special attention to simplicity, design and convenience of use. We also pay great attention to the service so that customers are always comfortable working with us.

One of our advantages is that we have a complete solution for automation in offline and online modes, including Telegram bots for sales and online stores.

- How can this product help the market of Uzbekistan?

- Basically, it can help a certain part of small and medium-sized businesses, which is our main focus.

In particular, our product can help make a certain segment of the business more efficient. Our customers save hundreds of hours, make more informed decisions based on data, and can control all processes online. We also help to develop online trading.

- How did you manage to attract the attention of foreign investors and get their investments?

Honestly, I don’t know. We just talked to all potential investors and shared our results, growth indicators, and vision and plans. Apparently, here we just converged on certain values and views of business.

- What struggles did you have to face on your way to investment $150 000?

- The search for investments to grow and scale the company began in early 2019. Already then we started looking for investors and talked to almost 10 potential investors from Britain, Egypt, Kazakhstan, Russia and Uzbekistan.

We wanted to find not just money, but also expertise in terms of scaling the company, as well as investors who shared our values and plans, regarding long-term vision.

In early March 2019, we almost closed the deal with Sarvar Ruzmatov, one of the founders of Payme, who planned to invest in our project. Sarvar was one of those investors that we very much wanted to see in the board, because he has good expertise in the construction of a scalable IT-company, and also has a good understanding of what we do.

We have already held negotiations, agreed on the terms of the deal and already thought that we closed the round, but then there was an unforeseen situation with the fact that Sarvar had a small share in the company, which could potentially become our competitor. His partners were therefore opposed to his initiative to invest. So we didn’t get the money or Sarvar in the board, which really upset us.

After that they began to communicate with different funds and people. We met Anvar Irchayev, who also wanted to invest in our project, but, unfortunately, we did not agree on the assessment of the company. After that he introduced us to the fund "Sturgeon Capital," for which we are very grateful to him.

We negotiated with Sturgeon for about 6 months. We met in the office, discussed the goals of the project, shared our figures and at one point we interested them as a startup. They were very suitable to us on cultural values, as well as on how they support companies in which they invest.

At first they offered to invest $500K in us, but at this stage companies, we simply cannot master such money usefully, and also did not want to erode heavily in shares, so agreed on phased financing within several years.

The most interesting thing is that when we almost agreed, investors began to appear who wanted to interrupt the deal. We had two such investors who wanted to go in as co-investors in a deal, or simply outbid the terms of a deal by offering more money on better terms. But, since we had already decided to move with "Sturgeon," we had to give it up, although it was tempting.

After we agreed on the assessment, we passed Due Diligence and received funding a couple of months later.

Difficulties faced by the startup:

Search of investors

At first we could not even think that there are so many investors who are looking for companies in Uzbekistan and willingly want to invest. We have practically no platforms or communities where you can get acquainted with the list of potential investors and see their profile and directions. All this happens at us through networking, that is, to find out the number and meet, it is necessary to look for friends who know these investors.

Long negotiations

It seemed to us that it took about a month to close the deal, but in practice it took us almost 9 months to lift the round. The first couple of months went to a closer acquaintance - team, numbers, tracking, etc. The rest of the time took to agree on documents, pass Due Diligence and find the right way to make a deal within the framework of Uzbek legislation.

We’ve been thinking through different options. We wanted to open a company in Estonia or Singapore that would run a local one to apply international law. But as it turned out, this is a costly way for a company of our size. As a result, they came to the fact that it is better to formalize everything within the framework of the legislation of Uzbekistan.

Legislation

By attracting a foreign investor, we have faced a number of difficulties related to the legislation. Our current legislation is not highly adapted to venture finance and start-ups in the early stages.

A startup usually has a product or idea and a small customer base early on. The problem is that in fact, the company’s statutory fund at this point may be very small, but realizing that the team has expertise, tracking and a large market where it is possible to scale, market terms of the deal are negotiated with the investor. Usually the investor at this stage evaluates the team and its potential, not the actual assets it has.

The biggest problem was that our statutory fund didn’t match the company’s market valuation and we had to inflate it so that the investor would only get the part we agreed on with him. Otherwise, it would turn out that the investor would become the owner of 99% of the stake in the company

Of course, it was all within the framework of the legislation, but this decision also has its disadvantages, and most importantly - it takes time and resources that could be spent on the development of the product and the company.

- How do you want to manage the received investments and develop BILLZ?

First of all, we raised investments to work on the product even more actively and to fulfill our mission to help small and medium-sized businesses in the field of trade. Small and medium-sized businesses are our main focus and around it we will build our entire product line. In order to develop faster and more qualitatively, we almost doubled the staff and attracted foreign developers, as we were unable to find suitable candidates from Uzbekistan.

Now we have a distributed team consisting of developers from Ukraine, Poland, Russia, Myanmar and Uzbekistan.

In the coming year we plan to improve the product and create what will help our clients to conduct their business even easier, more efficiently, and most importantly, to grow both online and offline.

We also plan to master new business vertically, but only those related to what we do not to lose our main focus. For example, this year we piloted the feature of providing scoring and installments, which we plan to, develop and improve further.

- Do you plan to enter foreign markets in the future?

- This year we will work only on the market of Uzbekistan, but from next year we plan to enter the markets of Kazakhstan, Kyrgyzstan and Tajikistan. They are very similar to our market in economics and mentality, so it will be easier for us to start international expansion with them.

For entry into the international market we prepare a separate version of the product, which will be adapted to specific needs. It is too early to talk about how we will do this, as we do not yet have a ready strategy to enter the international market. I think we will start this next year, and then we will move on iterations as problems come.

- How do you plan to cope with competition in the global market?

- We always try to focus not on competitors, but on clients and their problems and on this basis build the necessary product. Each market has its own unresolved problems, so first of all we will study them and think that around it is possible to build so that it is possible to scale and differ from competitors.

Of course, competitors always influence the course of events, but we believe that if you have a clear focus and a good product, you can find your place in the market.

But again it is too early to talk about it, because we do not have any clear figures, information and exit strategy, there are only intentions.

A spokesman for Sturgeon Capital, a junior analyst, Robin Butler, in turn, also answered several of our questions about what this fund is and why they decided to invest in BILLZ.

- Tell us a little about your investment fund.

- Sturgeon Capital manages assets in border markets, is based in the UK and has 15 years of investment experience in Central Asia and the Caucasus. In March 2020, Sturgeon launched the "Stock Growth Fund in Uzbekistan," the first international direct investment fund dedicated to investments in Uzbekistan. Current investors in the Fund represent a diverse group of leading global institutional investors, along with domestic capital. The fund invests in companies with proven business models and strong management that can become industry leaders in their sectors.

- Why did you invest in this project, what reasons influenced your choice?

- "Sturgeon" first met "Billz" in early 2019, and we were immediately impressed with the quality of both the management team and the product itself. Rustam Hamdamov and his team have already created a solid track record and demonstrated the viability of their product in the market. Throughout the process of deep financial analysis, Rustam always quickly provided the information we needed and answered any questions. As founder and CEO, Rustam has a clear idea of how business should develop, how to develop its product, and how it should develop domestically to sustain growth.. As financial investors we rely on the quality of the management team to execute the business plan, and in the case of "Billz" we are confident in their abilities and vision.

- Why do you think this project has potential?

In "Sturgeon," we find business-attractive ERP (Enterprise Resource Planning), SaaS (Software-as-a-Service) companies such as "Billz," due to its constant revenue model and the importance of the product to the end-user. Uzbekistan has huge opportunities for such companies for two reasons. First, many stores are still managed using Excel or papers, so "Billz" can significantly improve the efficiency and therefore profitability of these companies. Thus, its value proposition for potential customers is compelling.

Second, government reforms actively encourage stores to switch to digital and automated products, a catalyst for "Billz" s growth. A recent presidential executive order in April on the digital economy is an encouraging sign of the government’s commitment to modernizing the economy and increasing the digital economy’s share of GDP.

- Was it hard to choose which project to invest in?

- We were lucky in Uzbekistan because we see many interesting companies and business opportunities. The difficulty is getting the amount and detail of information we need to make an investment decision. For many companies, this is their first experience with international investors, so we usually have to spend time working with them to gather the necessary information before we can continue.

- Did you have any moments of doubt when choosing?

- Our comprehensive investment verification process is designed to provide us with the maximum amount of information about the company and the sector in which it operates, and it also allows us to know the founders and management. From the beginning it was clear to us that "Billz" not only has a quality product in an interesting market, but that Rustam and the rest of the team were very competent and motivated, which is essential for us.

"What kind of future do you have for this project?"

Now that we have completed our investment, we are pleased that Billz has many opportunities for growth. The team is working on developing a product to enter new business vertical and we believe that combining the "Billz" team with our financial support is a powerful combination for the company’s success. We believe that Billz can become the leading business software company in Uzbekistan and Central Asia, and we hope to support them on this journey.

After taking all interviews in the head sits only one thought, success can be achieved by everyone. Of course, this is not the final point of Rustam and his project called "Billz," it is only a starting point, a push that should eventually lead them even further, to even more finance, into the global market.

It should be recognized that such success stories give hope to many young children seeking successful development of their start-ups. And being simple guys as Rustam and his team, having an idea and wanting to change something for the better, hard work, desire and strong desire is possible to achieve real heights. There are not many such examples in our country yet. BUT if it is, all of them are united by two things - faith in themselves and the course, with the direction "only forward." Such people do not give up, do not despair and get what they want, what they seek!

2020-05-29