Building a unicorn: how much does your startup cost?

News from Elon Musk's famous business Space X first surfaced in the initial few months of this year. CNBC has been informed that the value of Elon Musk's business SpaceX, which makes reusable rockets and satellite Internet, has surpassed US$137 billion. Tesla's market capitalization resumed its lowest level since 2020 on January 3, the opening day of the NASDAQ American Stock Exchange, reaching $341 billion.

What does the capitalization of a company mean? In simple words, the capitalization of a company is the value of that company. Does it mean that for this amount one can buy a company? More likely no. Twitter was selling at $48 per share on the New York Stock Exchange when Elon Musk offered to purchase it for $54.20[1] per share. Thus, the capitalization of a company is the value of all shares of the company at current prices.

If the shares of the public company Tesla are traded daily on the stock exchange and from this price, it is possible to calculate the capitalization of the company on a certain date, for the shares of the private company Space X there is no such market. So, how do we know that Space X's valuation has hit $137 billion? The value of all of the company's shares at the cost of the most recent "bidding" is taken into account, precisely in the same manner as with publicly traded businesses. So, as part of a new funding round, Space X is raising $750 million at a valuation of $137 billion. From here, we can infer that the company, which was valued at $140 billion when Elon Musk offered his shares at $77 per share, is now priced slightly lower.

However, not all these discussions explain where the evaluation of a private company comes from. Why did investors, led by venture capital firm Andreessen Horowitz (also known as a16z. A and Z are the first and last letters of the founders' surnames and 16 letters between them), give an estimate of exactly 137 billion. The price of shares on stock exchanges is formed because of the interaction of supply and demand for a specific share. When more people want to buy a stock than sell it, the price goes up, and when more people want to sell a stock than buy it, the price goes down. Company performance, market and overall economic conditions, and even a sex scandal with the CEO of the company are examples of factors that affect supply and demand. Shares of private companies do not trade with such frequency where the price depends on supply and demand in real time.

How much does the idea cost?

If a potential investor is contacted and offered to invest in a company that buys mobile phones in the United Arab Emirates and then sells them with markups in Tashkent, the investor is likely to be aware of the profitability—and perhaps even the loss ratio of such a venture. It is much easier to calculate and show the required amount of investment and business margin. At the idea stage, investing in startups is a financial industry with significant high risk. If now it seems to you that the idea of letting a stranger into the house from the Internet for payment is quite safe and a good additional source of income, then imagine what the reaction of investors was in 2008 when they first heard the idea of Brian Chesky and Joe Gebbia, the founders of Airbnb[2]. Paul Graham, the founder of Y Combinator, who did not like the concept but was impressed by the founders' inventiveness in raising capital for their startup, still accepted Airbnb into YC.

So, how much does my startup cost?

The startup phases should be mentioned before moving on to assessment. Startups can be categorized based on funding rounds (pre-sees, seed, Series A, B, C, etc.). Raising funds and categorizing them is often closely related to the following stages of their development:

Idea/Concept Stage: In this stage, the founders have an idea for a business, but it has not yet been tested or validated.

Research and Development Stage: In this stage, the founders test the idea, develop the product or service, and gather data about the target market.

Prototype stage: A startup creates a minimum viable product (MVP) to demonstrate the viability of a product or service.

Launch Stage: A startup formally launches its product or service and begins acquiring customers.

Growth Stage: A startup experiences rapid growth in revenue and customer base.

Maturity Stage: A startup reaches a steady state with a mature product, an established market position, and a more predictable revenue stream.

Decline stage: Unfortunately, this also happens and a startup has a decrease in revenue and market share, and it must either change direction or go out of business. In fact, a change in direction or termination of activity happens at any of the above stages.

A conditional startup evaluation can be set at any of these stages, when the first investment is raised. The valuation of a startup, as I have already mentioned above, depends on how much investors are willing to pay for a stake (shares) in a startup. Typically, a valuation round occurs in Series A. Institutional investors (VC firms, etc.) usually get involved in this round. They buy preferred shares and all investments raised through SAFE or convertible loans in the early stages are converted into shares at the price of such a round (or on a discount provided in related documents).

Assessment Method

Venture capital companies use a variety of methods to evaluate startups. If the startup is at a more advanced stage, this process includes a thorough financial analysis by MBA graduate financial analysts of all available metrics (Discounted Cash Flow, Free Cash Flow, Forecasts, Capital Burn Rate, CAC - Cost per Customer Acquisition, etc.). But Scott Kupor, the managing partner at Andreessen Horowitz, author of Sand Hill Road Secrets and Stanford Business School professor provided the best response I received regarding company valuation. When I asked how Andreessen Horowitz evaluates startups, he replied that often startup valuation has more to do with art than with financial performance analysis. In fact, the subjective opinion of the firm's partners about the future of a startup in which the firm wants to invest plays a greater role than financial or other indicators.

Investors typically use a combination of financial and quality factors in their research to assess startups. Some of the more common criteria include:

Finance. Startups with a proven track record of growing revenue, profitability, and positive cash flows are often more attractive to investors.

Market size. Investors are looking for startups that can break the rules of the game in large growth markets. At the same time, the volume of markets should usually be more than 10-20 billion dollars. Building a unicorn on a market worth a couple of hundred million dollars is impossible.

Competitive environment. The presence of experienced players and the level of competition in the market can affect the evaluation of a startup.

Intellectual property. Startups with patented technologies or unique intellectual property may score higher.

Startup management. The experience, skills and record of accomplishment of the startup management (founders) can have a significant impact on its valuation.

Vision. Founders must have a vision and be able to sell their vision from the earliest stages.

Product-to-market fit. Investors are looking for startups that have demonstrated a strong match between their products or services and their target markets. This is called product-market fit.

Attractiveness. Startups that have already been able to find paying customers, build partnerships, or show other signs of attraction are often seem more valuable to investors.

Growth potential. Startups with the potential for rapid growth and expandibility are often more attractive to investors. They always expect you to bring in at least a 10-fold return.

These criteria are not something of an established rules and each investor may have their own unique approach to valuation, but these are a few of the most commonly used factors. In addition to the subjective assessment and factors influencing such an assessment, startups are advised to put an emphasis on the ratio of the attracted (or desired) amount of investments and the intermediate stages and indicators that they need to achieve by the time of such fundraising:

|

Phase |

Pre-seed |

Seed |

Series A |

|

Interest |

Customer validation |

Product-market fit |

Extension |

|

Monthly growth |

0–20% |

15–30% |

25%+ |

|

Monthly revenue |

$0 - $75 000 |

$75 000 - $200 000 |

$200 000 + |

|

Team number |

2 + |

10 + |

20 + |

|

Product |

MVP |

Well-developed |

Commercially viable |

|

Investors |

Family and friends, accelerators, angels, pre-seed and micro venture funds |

Accelerators, angels, seed venture funds |

Venture capital funds investing in the Series A and growth stages |

|

Funding round |

$25 000 - $750 000 |

$750 000 - $4 000 000 |

$4 000 000 + |

|

Company evaluation |

$1 000 000 - $5 000 000 |

$5 000 000 - $12 000 000 |

$30 000 000 - $60 000 000 |

|

Document to bring investment |

SAFE/convertible loan |

Assessment round |

Assessment round |

Sure, a venture capital firm's financial experts put in a lot of time to research potential investments in addition to the partners' subjective opinions. In their analysis, investors use one or a combination of several of the following methods:

Market valuation ratios method: A method of evaluating a startup by comparing it to similar companies in the same industry and determining a multiple of income or profits by analyzing available M&A information. For example, if a newly acquired company had an income multiple of 4, a startup with a similar income potential could be valued at 4 times its projected income.

Future valuation multiplier method: A method of valuing a startup based on forecasts of future earnings and applying a multiplier to those forecasts. This approach assumes that the startup will grow at a certain rate and will generate a certain level of profit in the future, and the multiplier will be based on these forecasts.

Reproduction Costs: A method of evaluating a startup by determining the replication cost of its assets, products, and intellectual property. This approach assumes that the cost of a startup is equivalent to the cost of creating a similar business from scratch.

Berkus Method: A method of evaluating a startup based on factors such as idea, market opportunity, management team, and competition, and assigning points based on these factors. This approach is subjective and depends on the assessor's judgment.

|

Viable idea (initial assessment) |

$500 000 |

|

Prototype (reduces technological risk) |

$500 000 |

|

Quality control team (reduces risk at realization stage) |

$500 000 |

|

Strategic partnerships (reduces market risks) |

$500 000 |

|

Product release and sales (reduces production risks) |

$500 000 |

Venture valuation method: As the name implies, the venture valuation method is a method used by venture capital companies to evaluate the value of startups. This method is used to evaluate early-stage startups that do not have significant financial results, and is based on the assumption that the company's future results will be much better than its current performance. This method assumes that the value of a startup is proportional to the amount of money invested and the expected return and is commonly used by venture capital firms to determine the value of their portfolio companies.

Finally, it is important to point out that there are venture capital firms, angels and accelerators that invest under predetermined conditions. Regardless of the stage or performance of your startup, these investors offer a standard set of rating limit and investments for your company. Below are examples from the investment conditions of major accelerators:

Y Combinator invests $500 000 in each company on standard terms. The accelerator invests in two tranches:

1. $125 000 under SAFE in exchange for 7% share of the startup according to the post-investment assessment

2. $375 000 SAFE no valuation limit, with “Most Favored Nation”[3] clause

Techstars writes that the accelerator will invest up to $120 000 in exchange for a 6% stake in each participating company. However, it is not that simple. The investment amount is also divided into tranches:

1. $20 000 in exchange for 6% of the company's regular shares

2. 100 000 convertible loan investment (at the discretion of a startup).

It must be taken into consideration that, a convertible loan from an accelerator has an annual interest of 5%. The valuation limit for a convertible loan makes up $3 000 000 (this limit can be increased to $5 000 000).

Statistics and examples

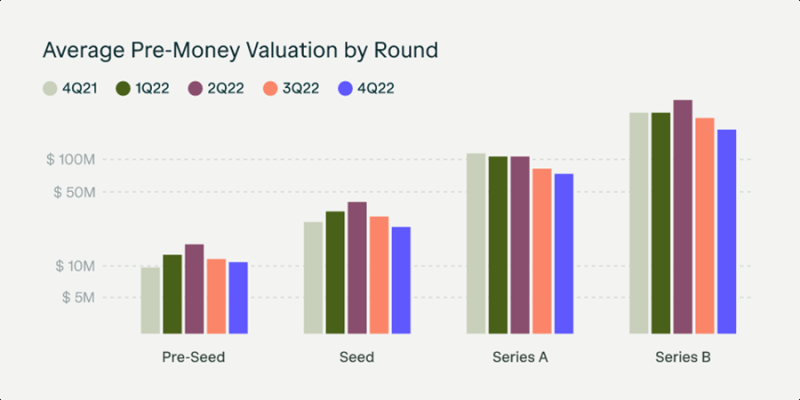

For a more accurate idea of how startups are evaluated, below is a chart of startup valuation prior to attracting investment in the US compiled by Angellist.

These figures, certainly, do not reflect the realities of the venture investment market in Uzbekistan. For a comparative assessment of your business, you can refer to examples of attracting investments from local startups from open sources.[4] For example, Jahongir Pulatov, co-founder of the Modme project, a platform for automating learning centers, recently said that the startup raised $100 000 at a $1.25 million valuation. Later it was revealed that investments were received from the national venture fund UzVC, which is the fourth company in the portfolio of this fund[5].

From open sources, one can learn that the national venture fund UzVC also invested $100 000 in startups such as Tass Vision[6] and Sug'urta Bozori[7]. Unfortunately, there is no information on the evaluation of these companies at the time of involving investments. This fund's fourth portfolio company is the Tajik startup zypl.ai. Neither the amount of the fund's investment nor the startup's valuation are known for this business.

[1] Due to Elon Musk's frequent reference to the number 420, many experts argue that this is a reference to cannabis use (4/20 is cannabis use in slang). At the same time, in a securities lawsuit, Elon Musk rejected the veracity of this statement.

[2] Airbnb - initially Airbed & Breakfast (air mattress and breakfast). The idea originates with Brian Chesky and Joe Gebbia, who began renting out an air mattress space at their home due to financial difficulties paying rent.

[3] If the startup offers more convenient terms for future investors, YC should receive the same conditions.

[7] https://www.spot.uz/ru/2022/09/14/uzvc-sugurta/

Author: Asror Arabjonov

2023-03-14